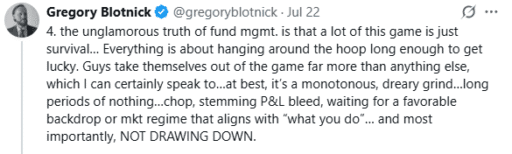

Fund management is not at all the glamorous pursuit it’s made out to be. The reality is often lonely, humbling, and mentally taxing. I wrote out a long Twitter thread venting about all of this, and given how everything on Twitter disappears within 24 hours, I saved it all down and posted it as a blog entry.

Read the full article here: 10 Unglamorous Truths of Hedge Fund Management – Gregory Blotnick

The content includes mindset and character traits that matter most in long/short equity investing, specifically patience, discipline, and humility. While Finance Twitter (FinTwit) often obsesses over idea generation, experience has taught me that execution and emotional self-control are what actually separate the best managers from everybody else.

“The mental impact, moreso than the financial impact, is what f*cks you in a drawdown…the opportunity finally arrives/regime changes, you should be aggressively pushing chips in, but you’ve lost the killer instinct…that’s what dooms you, or at least, it’s what has doomed me on several occasions…lack of PATIENCE and DISCIPLINE when your process isn’t working. This creates self-defeating negative feedback loops, tempts you into style drift or just doing outright stupid sh*t out of desperation…hardest part of the game by far, and again, like sizing or self-mastery, you don’t really see these things discussed on here.

Some key themes from the article include:

- Why most managers end up executing poorly

- How Twitter can distract managers from what really matters

- The psychological cost of drawdowns and how they destroy both mental and financial capital

- Why self-awareness and solitude matter more than anything else

“To borrow a turn of phrase from Montaigne…there is only one way to hit the bullseye, but there are thousands of ways to miss it. There are guys who take too much risk. There are guys who are gun-shy and don’t take enough. Some size positions too large, some too small. So to ask someone on here what you should do…homeboy…only YOU know the answer to that. Again, it’s not about your ideas, it’s about execution, and that’s a function of YOUR temperament.”

The piece is a raw, I suppose frustrated reflection on both success and failure, written for anyone serious about improving their performance both in markets and in life. If you’re an aspiring fund manager, investor or trader, or just curious about the inner world of fund management, you will get something out of it.

Good luck trading,

GB